(…And I’ll tell you how)

Well, today is April Fool’s Day — but this post is no joke.

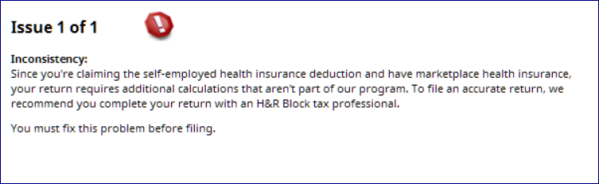

I’m a long time H&R Block user– but H&R Block essentially bit the dust when it didn’t manage to include the ability to reconcile the self employed health insurance deductions with exchange premium credit eligibility: all self-employed taxpayers who bought policies from Healthcare.gov or their state exchange during 2014 are out of luck. We’re greeted with a message that the software can’t do our taxes this year.

So off I went to buy new software. This isn’t a good year for TurboTax users either, because this it the year that TurboTax changed it’s program and pricing policies. If you want to have the program prepare a Schedule C, you’ve got to buy the highest price “Home and Business” edition — listed at $104.99 on the TurboTax softeare for the online product; $99.99 for the downloadable software.

But with a little shopping around I saved $35 — Amazon Prime members can download the software for $64.99, at least for now. Other retailers, such as Costco, also offering similar discounts. Continue reading