Blogger Harry Sit has reviewed the 3 most popular tax software packages, employing a simple test to gauge accuracy of calculations of self employed health insurance deduction and premium tax credit. His review confirms what our contributors have collectively determined:

- TaxAct: Works; closely replicates IRS example, with slight discrepancy due to rounding.

- TurboTax: Works; closely replicates IRS example, with slight discrepancy due to rounding. However, taxpayers who also need to prepare a Schedule C will need to purchase the highest price, “Home & Business Edition”.

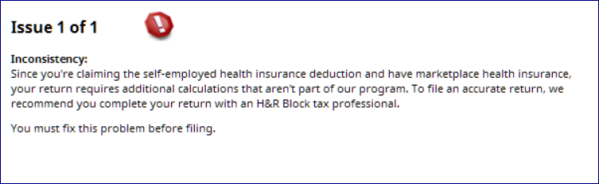

- H&R Block: Total fail. Users are advised that the software package does not include necessary features to prepare tax returns for self employed taxpayers who have purchased insurance via an exchange.

Read the whole post at The Finance Buff